Debt to assets ratio d. We derive these new liquidity measures and discuss their validity in.

Ratio Analysis Classification Of Liquidity Ratio

Which of the following is not a measure of liability liquidity.

. Equal the difference between actual current deposits and the base estimate of core deposits. For example if a companys cash ratio was 85 investors and analysts may consider that too high. Loan losses to deposits.

Which of the following is not likely to be used to measure a companys liquidity. D Current cash debt. Which of the following usually is least important as a measure of short-term liquidity.

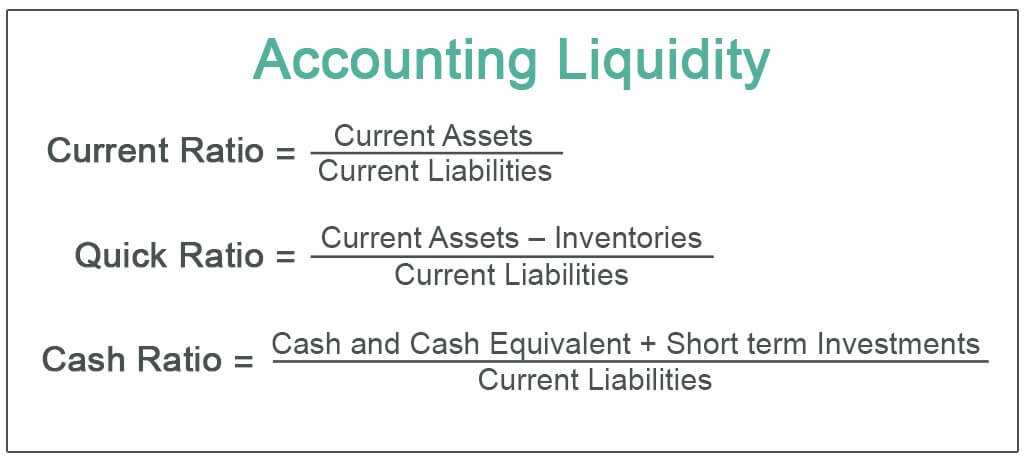

Creditor will not likely use assets turnover ratio. There are following types of liquidity ratios. Cash Ratio also known Cash Asset Ratio or Absolute Liquidity Ratio.

Let us know more in detail about these ratios. Which of the following is not a measure of liquidity. A Debt to total assets ratio.

B There are two commonly used ratios to measure liquidity current ratio and quick ratio. Which of the following measures the liquidity of a bond. Accounting questions and answers.

In finance and accounting the concept of a companys liquidity is its ability to meet its financial obligations. All of the above. THE MEASUREMENT OF LIQUIDITY 291 liquidity or to derive a simple liquidity index.

As debt to total assets ratio is not a current ratioIt means the amount of. A bank should consider all of the above when increasing liabilities to meet liquidity needs. The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term.

A Debt to total assets ratio. Which of the following is not considered a measure of liquidity. The ease of converting as asset cash with a minimum of.

Liquidity ratios are an important class of financial metrics used to determine a debtors ability to pay off current debt obligations without raising external capital. D Current cash debt coverage. Answer of Which of the following is not a measure of liquidity.

Working capital is one of the major measures of liquidity. Current Ratio or Working Capital Ratio. A Debt to assets ratio.

Quick Ratio also known as Acid Test Ratio. D Current cash debt coverage. The index retains nearly all of the information in the more complicated expression has intuitively appealing properties and is functionally related to the likelihood of technical insolvency.

Each of these answer choices are liquidity measures. Each of these answer choices are liquidity measures. Current Ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities.

The current ratio is one of the major measures of liquidity. 127 Which of the following is not considered a measure of liquidity. Which of the following is not a measure of liquidity.

Common liquidity ratios. Debt to assets ratio d. However Current ratio acid test ratio asset turnover ratio are liquidity ratios which is used.

Yes a company with a liquidity ratio of 85 will be able to confidently pay its short-term bills but investors may deem such a ratio excessive. Total deposits to total assets d. Assets turnover is efficiency ratio which measures companys ability to generate sale by use of total assets It is calculated to measure the efficiency of business.

Core deposits to total assets c. Net Working Capital Ratio. An abnormally high ratio means the company holds a large amount of liquid assets.

A companys liquidity is measured by the extent to which it has current assets ie cash marketable securities accounts receivable and inventory which can be readily used to satisfy its short-term obligations. Which of the following is not a measure of liquidity. Liquidity ratios assist in measuring the ability of a company to satisfy short-term obligations when they.

Total equity to total assets b. Federal funds sold to total assets e. Which of the following is not a measure of liquidity.

5 Ratings 12 Votes a Debt to total assets ratio. Which of the following is NOT true of liquidity ratios. The most common measures of liquidity are.

AMIT D answered on January 25 2021. A They measure the ability of the firm to meet short-term obligations with short-term assets without putting the firm in financial trouble. Price-earnings ratio Acid-test Average collection period O Working capital.

D Cash flows from operating activities.

Guide To Cryptocurrency Liquidity How To Measure Liquidity Trade Well

Accounting Liquidity Definition Formula Top 3 Accounting Liquidity Ratio

Liquidity Ratio Formula And Calculation Examples

Liquidity Risk Definition Example Measurement Of Liquidity Risk

0 Comments